Renters Insurance in and around Battle Creek

Get renters insurance in Battle Creek

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Trying to sift through savings options and deductibles on top of work, keeping up with friends and your pickleball league, can be overwhelming. But your belongings in your rented house may need the terrific coverage that State Farm provides. So when mishaps occur, your sports equipment, souvenirs and videogame systems have protection.

Get renters insurance in Battle Creek

Your belongings say p-lease and thank you to renters insurance

Why Renters In Battle Creek Choose State Farm

You may be doubtful that Renters insurance is really necessary, but what many renters don't know is that your landlord's insurance generally only covers the structure of the property. How much it would cost to replace your possessions can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when fires or break-ins occur.

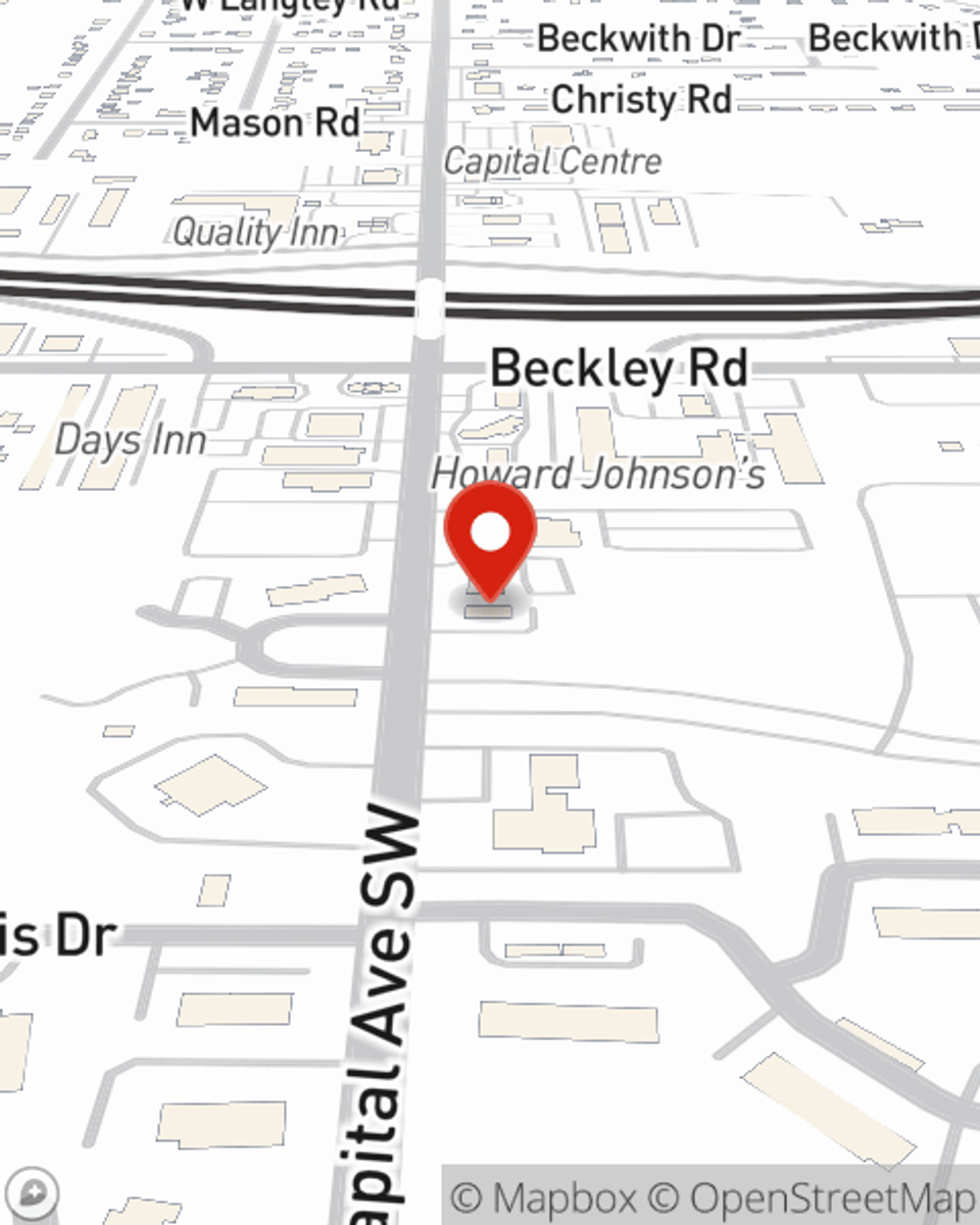

As a reliable provider of renters insurance in Battle Creek, MI, State Farm helps you keep your home safe. Call State Farm agent Paul Clark today and see how you can save.

Have More Questions About Renters Insurance?

Call Paul at (269) 979-4000 or visit our FAQ page.

Simple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Simple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.